What is a House Loan Estimate?

A house loan estimate is a document provided by a lender that outlines the estimated costs associated with obtaining a mortgage. It includes key details such as the loan amount, interest rate, monthly payments, and closing costs, giving borrowers a clear picture of their financial obligations.

Components of a House Loan Estimate

Loan Amount

The https://bighomeimprovement.com/ is the total amount of money you are borrowing from the lender to purchase the home. It is typically based on the purchase price of the property minus the down payment.

Interest Rate

The interest rate is the annual cost of borrowing money, expressed as a percentage of the loan amount. It directly impacts your monthly mortgage payments, with higher interest rates resulting in higher payments and vice versa.

Monthly Payments

The monthly payments section of the estimate breaks down your mortgage payment into principal and interest, as well as any additional costs such as property taxes, homeowners insurance, and mortgage insurance (if applicable).

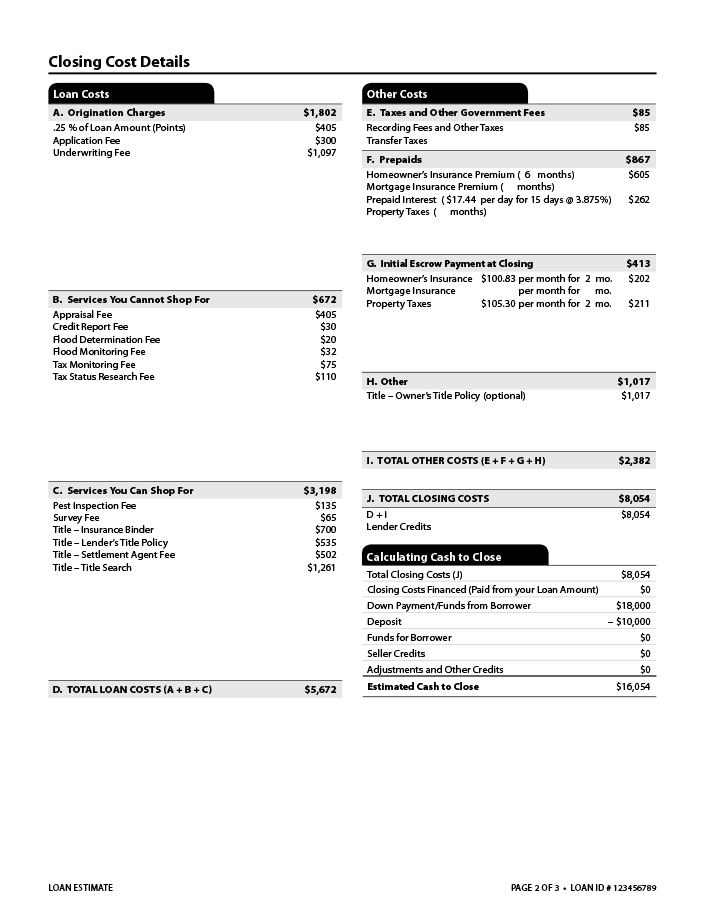

Closing Costs

Closing costs include fees and expenses associated with finalizing the mortgage loan and transferring ownership of the property. They may include appraisal fees, loan origination fees, title insurance, and attorney fees, among others.

How to Obtain a House Loan Estimate

Contact Lenders

Reach out to multiple lenders to request house loan estimates. Provide them with basic information about your financial situation and the property you’re interested in purchasing to receive accurate estimates.

Complete Pre-Approval

Some lenders may require you to complete the pre-approval process before providing a loan estimate. Pre-approval involves submitting documentation to verify your income, assets, and credit history, giving lenders the information they need to generate an accurate estimate.

Review and Compare

Once you’ve received house loan estimates from multiple lenders, take the time to review and compare them carefully. Pay attention to differences in interest rates, closing costs, and other terms to determine which offer best suits your needs and budget.

Factors That Can Impact the Accuracy of the Estimate

Market Conditions

Fluctuations in interest rates and housing market conditions can impact the accuracy of the estimate. Be aware that the terms of your loan offer may change if market conditions shift between the time you receive the estimate and the time you finalize the loan.

Property Details

The specifics of the property you’re purchasing, such as its location, condition, and appraised value, can also influence the accuracy of the estimate. Any changes to these factors may affect the final terms of your loan.

Credit Profile

Your credit score and financial history play a significant role in determining the interest rate and terms of your mortgage loan. Be upfront with lenders about your credit profile to ensure the estimate reflects your current financial situation accurately.

Conclusion

A house loan estimate provides valuable insights into the potential costs associated with financing your home purchase, helping you make informed decisions about your mortgage options. By understanding what goes into a house loan estimate, how to obtain one, and what factors can impact its accuracy, you can navigate the mortgage process with confidence and clarity.

In conclusion, obtaining a house loan estimate is an essential step in the home buying process, providing valuable information to borrowers as they explore their mortgage options.